skip to main |

skip to sidebar

BULLION

-

The earth is still cursed today; nor could it be otherwise.

-

The earth is still cursed today; nor could it be otherwise. The horrors and

heinous crimes brought to light in recent days with the publication of

Jeffrey ...

51 minutes ago

-

-

Market Talk – February 20, 2026

-

ASIA: The major Asian stock markets had a mixed day today: • NIKKEI 225

decreased 642.13 points or -1.12% to 56,825.70 • Shanghai closed • Hang

Seng de...

1 hour ago

-

Alasdair Macleod: Gold and silver are recovering

-

*By Alasdair MacleodGoldMoney, TorontoThursday, February 20, 2026*

In very low turnover on Comex, gold and silver begin to recover as

geopolitical tens...

4 hours ago

-

In the #News #Economy #Politics - Supreme Court Rules Againsts Tariffs

-

News “If you don't read the newspaper, you're uninformed. If you read the

newspaper, you're misinformed.”

“Whenever you find yourself on the side of the...

5 hours ago

-

Busy Friday

-

By TF

28 Comments | 7 Likes

Busy, busy, busy. That's what today is. We've already gotten the PCE and

GDP data but there;'s more to come with flash PMIs ...

8 hours ago

-

CCAC to Review 2027 Working Dogs and Youth Sports Coin Designs

-

The Citizens Coinage Advisory Committee (CCAC) will hold a videoconference

meeting on Tuesday, Feb. 24, to review U.S. Mint candidate designs for

upcomin...

8 hours ago

-

Massive & Beautiful: 2019 5 oz Mexican Silver Libertad

-

The 2019 5 oz Mexican Libertad stands out for a reason. ✨ Low mintage,

impressive weight, and a design that continues to ...

12 hours ago

-

D.C.’s Twin Rivers of Filth

-

This post D.C.’s Twin Rivers of Filth appeared first on Daily Reckoning.

Neither the D.C.’s pipes nor its institutions can hold back the rot anymore.

The...

1 day ago

-

-

-

Gold Explorer Expands Massive Project in Nevada's Walker Lane

-

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) finalizes an agreement to

acquire certain unpatented mining claims in the historic Como Mining

District from...

1 day ago

-

VERY STRANGE THINGS HAPPENING IN PRECIOUS METALS: You Have To See What Is

Happening Behind The Scenes In Metals Market

-

There is something very strange happening in the Precious Metals Market.

Unfortunately, most precious metals investors are unaware of what is

happening be...

2 days ago

-

Conheça Tudo Sobre Ragnarok: A Nova Geração dos Sites de Jogos Online

-

Índice Experiência de Gaming Premium Segurança e Licenciamento Formas de

Transação Disponíveis Sistema de Lealdade e Benefícios Apoio ao Cliente

24/7 Exp...

2 days ago

-

January 2026 Q&A

-

Q&A With Johnny: Q: What caused the rapid increase in the price of precious

metals in January? J: Okay, that’s a question! The short and simple answer

is...

1 week ago

-

Historic action for gold/silver

-

The precious metals of Gold and Silver saw net January gains of +$564.10

(13.0%) to $4886.71, and +$14.03 (19.9%) to $84.63 respectively.

Gold, monthly1...

2 weeks ago

-

A Comprehensive Look at First Majestic Silver Corp (AG)

-

First Majestic Silver Corp has long been one of the most widely followed

names in the global precious-metals mining sector. As a […]

The post A Comprehen...

3 months ago

-

Día de los Muertos Monetarios

-

Día de los Muertos Monetarios The Day the Dollar Died “In the end it is

not the gold that revalues, but the paper that reveals itself.” — Anonymous

Freego...

3 months ago

-

Gold, Silver and the Government Shutdown

-

The commentary below is from Investment Research Dynamic’s latest issue of

The Mining Stock Journal. Click the link to learn more about this valuable

news-...

4 months ago

-

Glitches

-

*Some technical glitches occurred with loss of articles recently as

important material was moved to the exclusive Benchmark website.*

*MP site is on care...

7 months ago

-

-

High Stake Games

-

Hello everyone. I'll preface this by saying this might be a bit more in the

weeds than many of you will care to explore. Hey, I get it, not everyone is

...

1 year ago

-

Desain Bentuk Rumah Adat China dan Penjelasannya

-

Rumah Adat China. Desain Bentuk Rumah Adat China dan Penjelasannya – Sudah

kita ketahui bersama bahwa Indonesia merupakan Negara yang kaya akan

warisan bud...

1 year ago

-

Daily Gold Market Report

-

Central Banks Drive Gold Towards $3000/Oz Amid Rising Geopolitical and

Economic Concerns (USAGOLD – 6/21/2024) Gold and silver prices are lower in

early ...

1 year ago

-

-

How to Get Yourself Out of a Payday Loan Debt Cycle?

-

Payday loans have become a prevalent financial resource for millions of

Americans facing short-term cash shortages. While initially marketed as a

solution ...

2 years ago

-

Silver-prices.net To Close, Future Content To Be Posted On Seeking Alpha

-

*We wish to inform you that we intend to close this website in the next few

months or so and also offer you an alternative, which is free to you, as we

w...

2 years ago

-

What if Deutsche Bank Derivatives Bubble suddenly Implodes into a Financial

Black Hole https://youtu.be/-MHQENdSK2k

-

What if Deutsche Bank Derivatives Bubble suddenly Implodes into a Financial

Black Hole https://youtu.be/-MHQENdSK2k Deutsche Bank Derivatives Bubble

sudden...

3 years ago

-

What if Deutsche Bank Derivatives Bubble suddenly Implodes into a Financial

Black Hole https://youtu.be/-MHQENdSK2k

-

What if Deutsche Bank Derivatives Bubble suddenly Implodes into a Financial

Black Hole https://youtu.be/-MHQENdSK2k Deutsche Bank Derivatives Bubble

sudden...

3 years ago

-

Pork Bellies are Gone, But Stores Still Have Bacon

-

Great and Wonderful Tuesday Morning Folks, The tamp continues, sort

of, with Gold now up 20 cents at $1,675.40 after dipping to $1,667.50 with

the hig...

3 years ago

-

Rivian Laying Off Approximately 840 Employees

-

Rivian Laying Off Approximately 840 Employees By John Gallagher of

FreightWaves Electric vehicle startup Rivian is laying off 6% of its

14,000-employee wor...

3 years ago

-

SILVER and the Collapse of the Global Financial System With David Morgan

-

In our current economic environment, the fragility of the FIAT currency at

the heart of the global financial system is beginning to show.

Precious metal...

3 years ago

-

Gold rallies but can’t clear key price level

-

*Precious metal prices rallied in October as inflation fears rose to the

top of the risk factors investors are watching. Silver was the standout,

rising by...

4 years ago

-

Ron Paul: Guess Who's The Taliban's Biggest Weapons Supplier?

-

The lightening-fast Taliban takeover of Afghanistan has left billions of

dollars of US weapons scattered around the country for the taking. And this

does...

4 years ago

-

The problem with climate change politics

-

Western economies have moved on from free markets to the point where they

hardly exist in the true meaning of the phrase. Yet the state continually

claims ...

4 years ago

-

👉How to Invest in Silver with Silver Expert John Lee The Silver Elephant !!

-

👉How to Invest in Silver with Silver Expert John Lee The Silver Elephant

!! 👉How to Invest in Silver with Silver Expert John Lee The Silver

Elephant !! J...

4 years ago

-

Operational Update

-

The last five days have seen a huge increase in silver demand from our

customers and increases in premiums from manufacturers and suppliers as

global dem...

5 years ago

-

The Ecstasy and The Agony of Market Bubbles

-

Miles Franklin sponsored this article by Gary Christenson. The opinions are

his and are not investment advice. At a glance: Tesla stock, Bitcoin, and

other...

5 years ago

-

Global Demand Continues to Threaten U.S. Oil Exports

-

In 2019, the United States imported about 6.8 million barrels per day (bpd)

of crude oil and exported about 3...

The post Global Demand Continues to Thre...

5 years ago

-

Gold and Silver Are Just Getting Started

-

The U.S. Mint made an unusual request last week. In a press release dated

July 23, the bureau literally begged Americans to start putting coins back

into c...

5 years ago

-

Gold Makes Record High and Targets $6,000 in New Bull Cycle

-

[image: gold price prediction 2020]The gold price made a new all-time

nominal high today at $1,945 per ounce. This move should not come as a

surprise to an...

5 years ago

-

Trap Cleaning Service – Clean Traps With Houston Businesses

-

Every year, thousands of people visit the Houston business district to do

some cleaning, but many Houston-area business owners are embarrassed by

their gre...

5 years ago

-

ファイザー製薬バイアグラのシルデナフィルでED改善

-

EDになると、若い頃のような性行為が出来なくなるので、パートナーに嫌われるのではないかと悩んでいる男性は少なくありません。

スーパーやドラッグストアに行けば精力剤が買えますが、それを試しても効果がなかった場合は、ファイザー製薬が製造しているバイアグラを使うことをおすすめします。

バイアグラの有効成分のシル...

5 years ago

-

Silver Is Ensured A Prosperous 2020 Thanks To The Fed

-

Snippet:

In my previous article, I’ve written about how important US dollar

movements are for future Silver prices. The chances of a significant Silver

r...

5 years ago

-

20 Months, 2 Weeks (Addendum)

-

Bullion... who?

It has been nearly 2 years (20 month, 2 weeks) since my last post on this

site (Fin). A short time after writing that post I cleaned up the...

5 years ago

-

The Covid-19 Dominoes Fall: The World Is Insolvent

-

To understand why the financial dominoes toppled by the Covid-19 pandemic

lead to global insolvency, let’s start with a household example. The point

of thi...

5 years ago

-

Marc Faber Podcast on Gold, Inflation, and Emerging Markets

-

Marc Faber Podcast on Gold, Inflation, and Emerging Markets

* Contrarian Investor Dr.Marc Faber is an international investor known...

5 years ago

-

2020 wedge tailed eagle high relief coin

-

-

[image: Perth Mint Coin Profiles - Australia 2020 Wedge-Tailed Eagle 1oz

Silver Proof High Relief Coin]

This extraordinary 1oz silver high relief c...

6 years ago

-

Warning : Silver is Ready to Launch says Todd Horwitz

-

Silver's bullish price action is yet to come, with a target of near $20

coming soon, this according to Todd Horwitz of bubbatrading.com. "To me,

we're goi...

6 years ago

-

Tips on Starting & Building Your Bullion Portfolio

-

Investing in the precious metals market might feel harrowing at first, as

the options available to you are great, offering innumerable valuable

products th...

6 years ago

-

Financial Expert WARNS PREPARE NOW! “God, Gold, Guts”

-

David Heavener and David Morgan discuss the coming economic collapse.

Cashless society. The chip. What is real money? Should I buy gold? or

silver? Let My ...

6 years ago

-

Fractional reserve bullion banking and gold bank runs

-

Below is a series of post explaining how I suspect bullion banking

operates, which is necessary for a true understanding of how susceptible it

is to a gold...

7 years ago

-

-

China’s Secret Gold Supplier Is Singapore

-

Singapore has been a major gold supplier to China since 2013, which was

previously not publicly known. According to Statlink, Singapore net

exported 102 ...

7 years ago

-

Drama Korea Uncontrollably Fond (2016) Subtitle Indonesia Complete

-

*Detail K-Drama Uncontrollably Fond Subtitle Indonesia :* Judul :

Uncontrollably Fond

Production Company: Samhwa Networks & iHQ

Sutradara : Park Hyun Suk

...

7 years ago

-

34 minute Free Crypto Trading Course

-

34 minute Free Crypto Trading Course

CONTENT DISCLAIMER: I am not a financial advisor nor do I have a CMT

certificate or anything of the like. Any decisi...

8 years ago

-

The Year of the Dog Begins and Gold Gains 3% On the Week

-

The Year of the Dog Begins and Gold Gains 3% On the Week

The Chinese New Year, also known as the Spring Festival, begins today and

formally initiates the...

8 years ago

-

Crypto Update 2/5/18 World Ponzi

-

Crypto Update 2/5/18 World Ponzi

To get these updates immediately, you can become a member at

http://brotherjohnf.biz/plans/subscriptions https://www.wor...

8 years ago

-

Cryptocurrency ‘Bloodbath’ Takes Bitcoin Below $10,000, Is the Crypto

Revolution Over?

-

Bitcoin, the number one cryptocurrency, is down by 20.47% in the last

24-hour period, according to CoinMarketCap. The flagship cryptocurrency is

now trad...

8 years ago

-

10 Ways America Is Falling Behind

-

zerohedge.com / by Shane Savitsky via Axios.com / 12/31/2017

If 2017 has seemed to you like a long and terrible year filled with bad

news, then here’s s...

8 years ago

-

Fanciful Fed Follies

-

Michael Ballanger

8 years ago

-

Fed Rate Hikes, Fiscal v. Monetary Policy Why Again the Case for Gold?

-

What again is the case for gold? Real, heavy, in-your-hand gold? It is an

anchor to the time before the Good Ship Lollypop set sail on these

uncharted waters.

8 years ago

-

USDollar index ahead of FED meeting

-

Greetings traders!

2 scenarios ahead of FED meeting for US dollar index.

Trade smart, trade safe!

8 years ago

-

-

Gold Unleashed by Fed

-

Gold's next major upleg was likely unleashed by a very-dovish FOMC this

week, which now has its hands tied on hiking rates or being hawkish due to

the US e...

9 years ago

-

Brexit post-mortem

-

It is a month after Britain’s surprise vote to leave the EU.

A new Conservative Prime Minister and Chancellor are in place, both David

Cameron and George ...

9 years ago

-

This Day in MV History: Precious Metals

-

These articles were published on Minyanville.com on 26th April in History.

Checkout how time flies enjoy reading!Despite "Divorce Rate Indicator"

Stock Cha...

9 years ago

-

Nearly there?

-

Hello everyone.

2015 draws to a close, so I thought I'd try to emulate GM Jenkins with a

few charts for you. I have found a whizzo new (free) charting site...

10 years ago

-

What is a Bitcoin Worth? It Might Depend on the Price of Gold

-

What is a bitcoin worth? The answer may rest with the price of gold as both

currencies compete to be the preferred investment during economic

instability.

10 years ago

-

Gold at $64,000—Bloomberg’s ‘China Gold Price’

-

"JPMorgan et al, which certainly includes the BIS, have an iron grip on

prices"

¤ Yesterday In Gold & Silver

The gold price traded flat until it develop...

10 years ago

-

House Prices in New Zealand v Gold, April 2015

-

_____________________________________________________________

The Anglo-Far East Company

AFE is the gold bullion custodial provider of choice for the so...

10 years ago

-

American Gold Eagle Bullion Coin Sales Up Sharply in March

-

According to the latest report from the US Mint, sales of the American Gold

Eagle bullion coins soared in March from both the previous month’s sales

and ...

10 years ago

-

Gold Market Sentiment Model – How it works

-

I had a question the other day asking “Does term “sudden” in your chart

relevant to second derivative? In any …

Continue reading →

10 years ago

-

It's all in Interest Rate Expectations

-

I am referring to the gold price in the above title. By that I mean,

whatever market participants think as to when the Fed is going to make the

first move ...

10 years ago

-

Somebody accurately called the oil bear market...

-

I'm not trying to brag or anything here, but I called it. And it just goes

to show for the fundamentalists among us, that we might have to wait a

little lo...

11 years ago

-

Why Cash Is King

-

In investing, the hardest thing to do is nothing. There is always the hot

new stock or sector that demands our attention. In investing as in life,

the ha...

11 years ago

-

-

*YES, LIKE CONTINUING TO COME HERE FOR -vegas INFO*

*NEW POST IS UP AT www.traderzoo.mobi WHERE I TALK ABOUT FX CONDITIONS THE

LAST COUPLE OF DAYS AND WHA...

11 years ago

-

-

-

-

-

-

-

-

The Geo-Politics of the Strait of Hormuz: Could the U.S. Navy be defeated by Iran in the Persian Gulf?

After years of U.S. threats, Iran is taking steps which suggest that is both willing and capable of closing the Strait of Hormuz. On December 24, 2011 Iran started its Velayat-90 naval drills in and around the Strait of Hormuz and extending from the Persian Gulf and Gulf of Oman (Oman Sea) to the Gulf of Aden and the Arabian Sea.

Since the conduct of these drills, there has been a growing war of words between Washington and Tehran. Nothing the Obama Administration or the Pentagon have done or said so far, however, has deterred Tehran from continuing its naval drills.

The Geo-Political Nature of the Strait of Hormuz

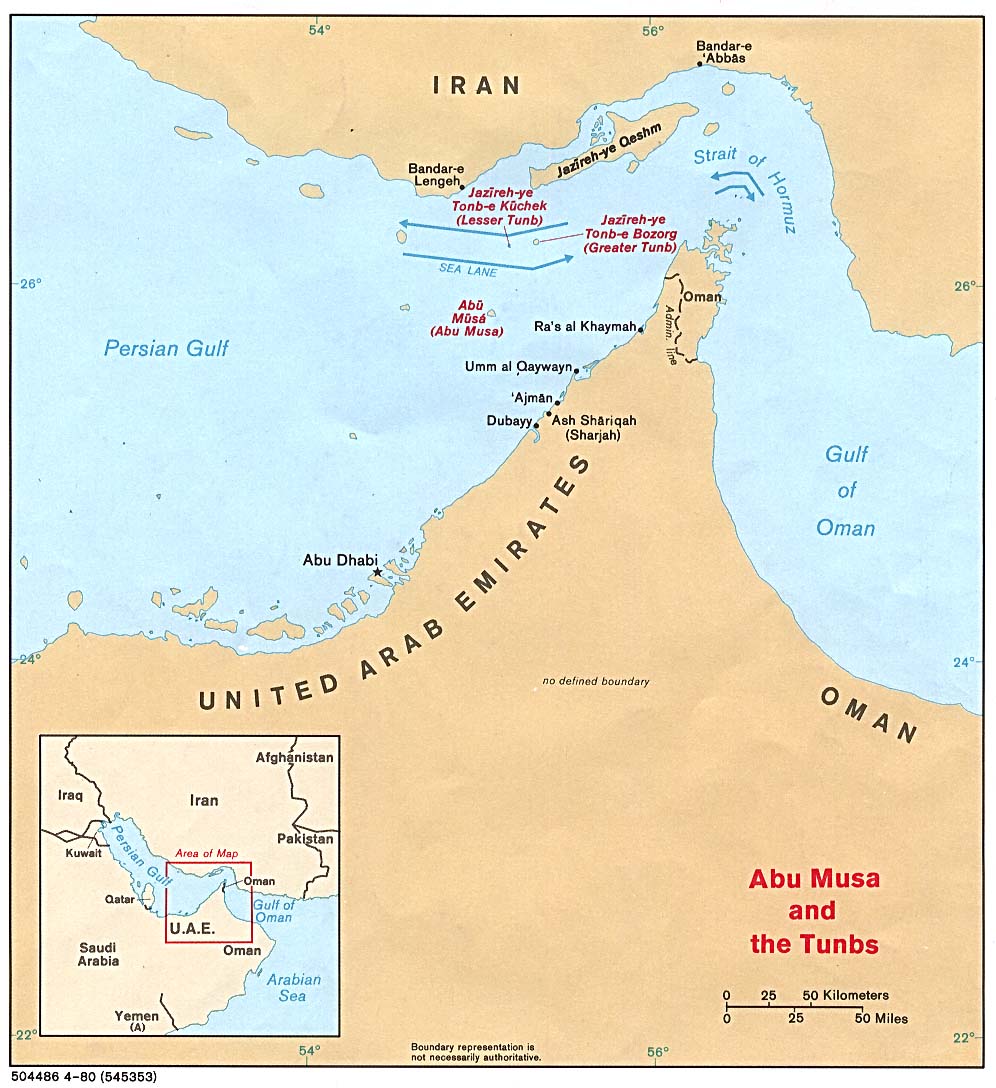

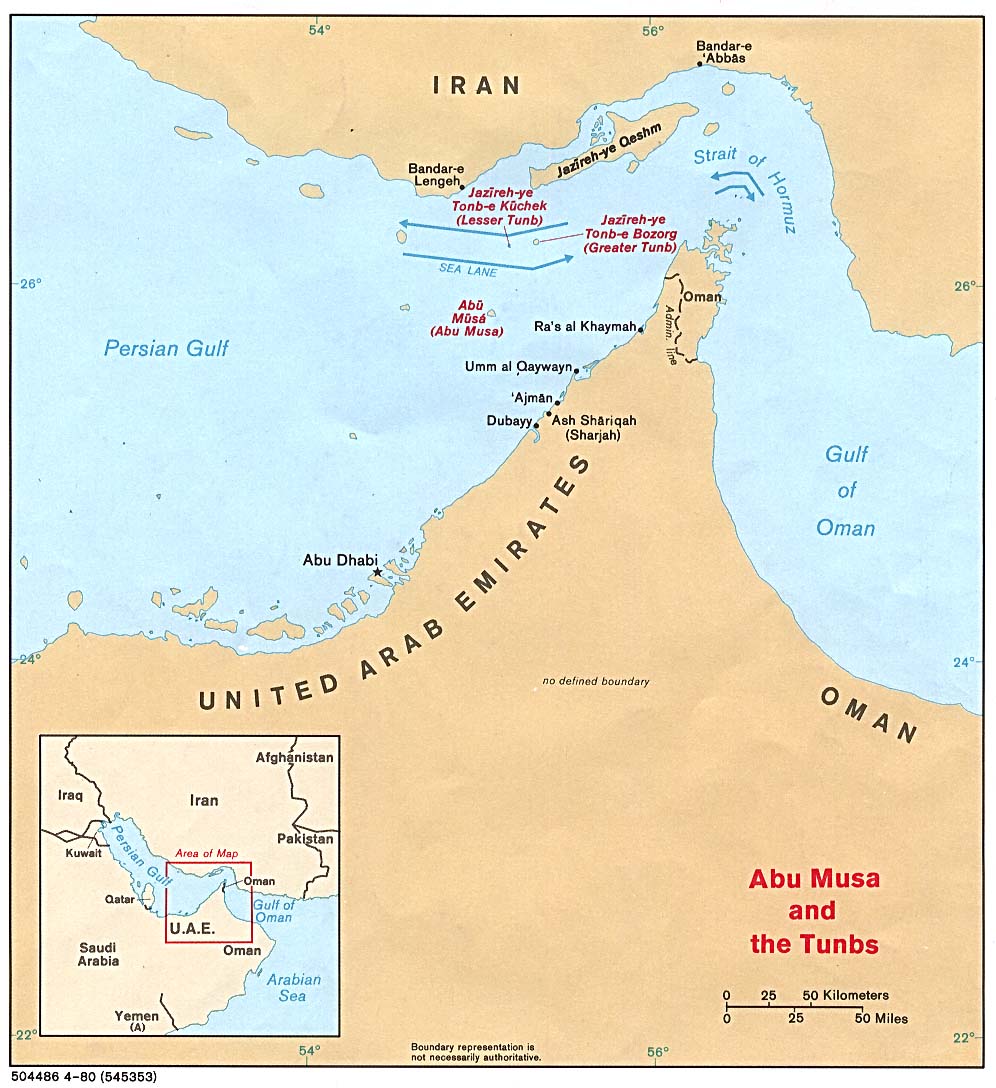

Besides the fact that it is a vital transit point for global energy resources and a strategic chokepoint, two additional issues should be addressed in regards to the Strait of Hormuz and its relationship to Iran. The first concerns the geography of the Strait of Hormuz. The second pertains to the role of Iran in co-managing the strategic strait in accordance with international law and its sovereign national rights.

The maritime traffic that goes through the Strait of Hormuz has always been in contact with Iranian naval forces, which are predominantly composed of the Iranian Regular Force Navy and the Iranian Revolutionary Guard Navy. In fact, Iranian naval forces monitor and police the Strait of Hormuz along with the Sultanate of Oman via the Omani enclave of Musandam. More importantly, to transit through the Strait of Hormuz all maritime traffic, including the U.S. Navy, must sail through Iranian territorial waters. Almost all entrances into the Persian Gulf are made through Iranian waters and most exits are through Omani waters.

Iran allows foreign ships to use its territorial waters in good faith and on the basis of Part III of the United Nations Convention of the Law of the Sea’s maritime transit passage provisions that stipulate that vessels are free to sail through the Strait of Hormuz and similar bodies of water on the basis of speedy and continuous navigation between an open port and the high seas. Although Tehran in custom follows the navigation practices of the Law of the Sea, Tehran is not legally bound by them. Like Washington, Tehran signed this international treaty, but never ratified it.

American-Iranian Tensions in the Persian Gulf

In recent developments, the Iranian Majlis (Parliament) is re-evaluating the use of Iranian waters at the Strait of Hormuz by foreign vessels.

Legislation is being proposed to block any foreign warships from being able to use Iranian territorial waters to navigate through the Strait of Hormuz without Iranian permission; the Iranian Parliament’s National Security and Foreign Policy Committee is currently studying legislation which would establish an official Iranian posture. The latter would hinge upon Iranian strategic interests and national security. [1]

On December 30, 2011, the U.S.S. John C. Stennis carrier passed through the area where Iran was conducting its naval drills. The Commander of the Iranian Regular Forces, Major-General Ataollah Salehi, advised the U.S.S. John C. Stennis and other U.S. Navy vessels not to return to the Persian Gulf while Iran was doing its drills, saying that Iran is not in the habit of repeating a warning twice. [2] Shortly after the stern Iranian warning to Washington, the Pentagon’s press secretary responded by making a statement saying: “No one in this government seeks confrontation [with Iran] over the Strait of Hormuz. It’s important to lower the temperature.” [3]

In an actual scenario of military conflict with Iran, it is very likely that U.S. aircraft carriers would actually operate from outside of the Persian Gulf and from the southern Gulf of Oman and the Arabian Sea. Unless the missile systems that Washington is developing in the petro-sheikhdoms of the southern Persian Gulf are operational, the deployment of large U.S. warships in the Persian Gulf would be unlikely. The reasons for this are tied to geographic realities and the defensive capabilities of Iran.

Geography is against the Pentagon: U.S. Naval Strength has limits in the Persian Gulf

U.S. naval strength, which includes the U.S. Navy and the U.S. Coast Guard, has primacy over all the other navies and maritime forces in the world. Its deep sea or oceanic capabilities are unparalleled and unmatched by any other naval power. Primacy does not mean invincibility. U.S. naval forces in the Strait of Hormuz and the Persian Gulf are nonetheless vulnerable.

Despite its might and shear strength, geography literally works against U.S. naval power in the Strait of Hormuz and the Persian Gulf. The relative narrowness of the Persian Gulf makes it like a channel, at least in a strategic and military context. Figuratively speaking, the aircraft carriers and warships of the U.S. are confined to narrow waters or are closed in within the coastal waters of the Persian Gulf. [See map above]

This is where the Iranian military’s advanced missile capabilities come into play. The Iranian missile and torpedo arsenal would make short work of U.S. naval assets in the waters of the Persian Gulf where U.S. vessels are constricted. This is why the U.S. has been busily erecting a missile shield system in the Persian Gulf amongst the Gulf Cooperation Council (GCC) countries in the last few years.

Even the small Iranian patrol boats in the Persian Gulf, which appear pitiable and insignificant against a U.S. aircraft carrier or destroyer, threaten U.S. warships. Looks can be deceiving; these Iranian patrol boats can easily launch a barrage of missiles that could significantly damage and effectively sink large U.S. warships. Iranian small patrol boats are also hardly detectable and hard to target.

Iranian forces could also attack U.S. naval capabilities merely by launching missile attacks from the Iranian mainland on the northern shores of the Persian Gulf. Even in 2008 the Washington Institute for Near East Policy acknowledged the threat from Iran’s mobile coastal missile batteries, anti-ship missiles, and missile-armed small ships. [4] Other Iranian naval assets like aerial drones, hovercraft, mines, diver teams, and mini-submarines could also be used in asymmetrical naval warfare against the U.S. Fifth Fleet.

Even the Pentagon’s own war simulations have shown that a war in the Persian Gulf with Iran would spell disaster for the United States and its military. One key example is the Millennium Challenge 2002 (MC02) war game in the Persian Gulf, which was conducted from July 24, 2002 to August 15, 2002 and took almost two years to prepare. This mammoth drill was amongst the largest and most expensive war games ever held by the Pentagon. Millennium Challenge 2002 was held shortly after the Pentagon had decided that it would continue the momentum of the war in Afghanistan by targeting Iraq, Somalia, Sudan, Libya, Lebanon, Syria, and finishing off with the big prize of Iran in a broad military campaign to ensure U.S. primacy in the new millennium.

After Millennium Challenge 2002 was finished, the war game was “officially” presented as a simulation of a war against Iraq under the rule of President Saddam Hussein, but in actuality these war games pertained to Iran.[5] The U.S. had already made assessments for the upcoming Anglo-American invasion of Iraq. Moreover, Iraq had no naval capabilities that would merit such large-scale use of the U.S. Navy.

Millennium Challenge 2002 was conducted to simulate a war with Iran, which was codenamed “Red” and referred to an unknown Middle Eastern rogue enemy state in the Persian Gulf. Other than Iran, no other country could meet the perimeters and characteristics of “Red” and its military forces, from the patrol boats to the motorcycle units. The war simulation took place because Washington was planning on attacking Iran soon after invading Iraq in 2003.

The scenario in the 2002 war game started with the U.S., codenamed “Blue,” giving Iran a one-day ultimatum to surrender in the year 2007. The war game’s date of 2007 would chronologically correspond to U.S. plans to attack Iran after the Israeli attack on Lebanon in 2006, which was to extend, according to military plans, into a broader war against Syria. The war against Lebanon, however, did not go as planned and the U.S. and Israel realized that if Hezbollah could challenge them in Lebanon then an expanded war with Syria and Iran would be a disaster.

In Millennium Challenge 2002’s war scenario, Iran would react to U.S. aggression by launching a massive barrage of missiles that would overwhelm the U.S. and destroy sixteen U.S. naval vessels – an aircraft carrier, ten cruisers, and five amphibious ships. It is estimated that if this had happened in real war theater context, more than 20,000 U.S. servicemen would have been killed in the first day following the attack. [6]

Next, Iran would send its small patrol boats – the ones that look insignificant in comparison to the U.S.S. John C. Stennis and other large U.S. warships – to overwhelm the remainder of the Pentagon’s naval forces in the Persian Gulf, which would result in the damaging and sinking of most of the U.S. Fifth Fleet and the defeat of the United States. After the U.S. defeat, the war games were started over again, but “Red” (Iran) had to operate under the assumption of handicaps and shortcomings, so that U.S. forces would be allowed to emerge victorious from the drill. [7] This outcome of the war games obviated the fact that the U.S. would have been overwhelmed in the context of a real conventional war with Iran in the Persian Gulf.

Hence, the formidable naval power of Washington is handicapped both by geography as well as Iranian military capabilities when it comes to fighting in the Persian Gulf or even in much of the Gulf of Oman. Without open waters, like in the Indian Ocean or the Pacific Ocean, the U.S. will have to fight under significantly reduced response times and, more importantly, will not be able to fight from a stand-off (militarily safe) distance. Thus, entire tool boxes of U.S. naval defensive systems, which were designed for combat in open waters using stand-off ranges, are rendered unpractical in the Persian Gulf.

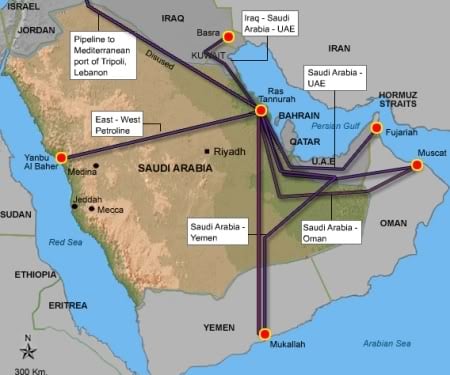

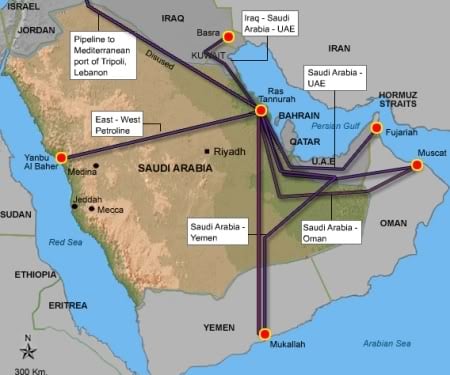

Making the Strait of Hormuz Redundant to Weaken Iran?

The entire world knows the importance of the Strait of Hormuz and Washington and its allies are very well aware that the Iranians can militarily close it for a significant period of time. This is why the U.S. has been working with the GCC countries – Saudi Arabia, Qatar, Bahrain, Kuwait, Oman, and the U.A.E. – to re-route their oil through pipelines bypassing the Strait of Hormuz and channelling GCC oil directly to the Indian Ocean, Red Sea, or Mediterranean Sea. Washington has also been pushing Iraq to seek alternative routes in talks with Turkey, Jordan, and Saudi Arabia.

Both Israel and Turkey have also been very interested in this strategic project. Ankara has had discussions with Qatar about setting up an oil terminal that would reach Turkey via Iraq. The Turkish government has attempted to get Iraq to link its southern oil fields, like Iraq’s northern oil fields, to the transit routes running through Turkey. This is all tied to Turkey’s visions of being an energy corridor and important lynchpin of transit.

The aims of re-routing oil away from the Persian Gulf would remove an important element of strategic leverage Iran has against Washington and its allies. It would effectively reduce the importance of the Strait of Hormuz. It could very well be a prerequisite to war preparations and a war led by the United States against Tehran and its allies.

It is within this framework that the Abu Dhabi Crude Oil Pipeline or the Hashan-Fujairah Oil Pipeline is being fostered by the United Arab Emirates to bypass the maritime route in the Persian Gulf going through the Strait of Hormuz. The project design was put together in 2006, the contract was issued in 2007, and construction was started in 2008. [8] This pipeline goes straight from Abdu Dhabi to the port of Fujairah on the shore of the Gulf of Oman in the Arabian Sea.

In other words, it will give oil exports from the U.A.E. direct access to the Indian Ocean. It has openly been presented as a means to ensure energy security by bypassing Hormuz and attempting to avoid the Iranian military. Along with the construction of this pipeline, the erection of a strategic oil reservoir at Fujairah was also envisaged to also maintain the flow of oil to the international market should the Persian Gulf be closed off. [9]

Aside from the Petroline (East-West Saudi Pipeline), Saudi Arabia has also been looking at alternative transit routes and examining the ports of it southern neighbours in the Arabian Peninsula, Oman and Yemen. The Yemenite port of Mukalla on the shores of the Gulf of Aden has been of particular interest to Riyadh. In 2007, Israeli sources reported with some fanfare that a pipeline project was in the works that would connect the Saudi oil fields with Fujairah in the U.A.E., Muscat in Oman, and finally to Mukalla in Yemen. The reopening of the Iraq-Saudi Arabia Pipeline (IPSA), which was ironically built by Saddam Hussein to avoid the Strait of Hormuz and Iran, has also been a subject of discussion for the Saudis with the Iraqi government in Baghdad.

If Syria and Lebanon were converted into Washington’s clients, then the defunct Trans-Arabian Pipeline (Tapline) could also be reactivated, along with other alternative routes going from the Arabian Peninsula to the coast of the Mediterranean Sea via the Levant. Chronologically, this would also fit into Washington’s efforts to overrun Lebanon and Syria in an attempt to isolate Iran before any possible showdown with Tehran.

The Iranian Velayat-90 naval drills, which extended in close proximity to the entrance of the Red Sea in the Gulf of Aden off the territorial waters of Yemen, also took place in the Gulf of Oman facing the coast of Oman and the eastern shores of the United Arab Emirates. Amongst other things, Velayat-90 should be understood as a signal that Tehran is ready to operate outside of the Persian Gulf and can even strike or block the pipelines trying to bypass the Strait of Hormuz.

Geography again is on Iran’s side in this case too. Bypassing the Strait of Hormuz still does not change the fact that most of the oil fields belonging to GCC countries are located in the Persian Gulf or near its shores, which means they are all situated within close proximity to Iran and therefore within Iranian striking distance. Like in the case of the Hashan-Fujairah Pipeline, the Iranians could easily disable the flow of oil from the point of origin. Tehran could launch missile and aerial attacks or deploy its ground, sea, air, and amphibious forces into these areas as well. It does not necessarily need to block the Strait of Hormuz; after all preventing the flow of energy is the main purpose of the Iranian threats.

The American-Iranian Cold War

Washington has been on the offensive against Iran using all means at its disposal. The tensions over the Strait of Hormuz and in the Persian Gulf are just one front in a dangerous multi-front regional cold war between Tehran and Washington in the broader Middle East. Since 2001, the Pentagon has also been restructuring its military to wage unconventional wars with enemies like Iran. [10] Nonetheless, geography has always worked against the Pentagon and the U.S. has not found a solution for its naval dilemma in the Persian Gulf. Instead of a conventional war, Washington has had to resort to waging a covert, economic, and diplomatic war against Iran.

http://www.globalresearch.ca/index.php?context=va&aid=28516

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_bpoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_bpoz_2.gif)

My fear is that we will place a carrier group in the gulf and become a sitting duck to a suprise attack. Iran has sophisticated anti-ship missiles and it would be possible to cripple a carrier and a few support ships. The gulf is too small a pond for a carrier group.

ReplyDelete