One of the downsides of having government education camps (the school system) "educate" most of us slaves is that most of us have no clue what occured prior to our own lifetimes. And what we think we know is incorrect or never happened.

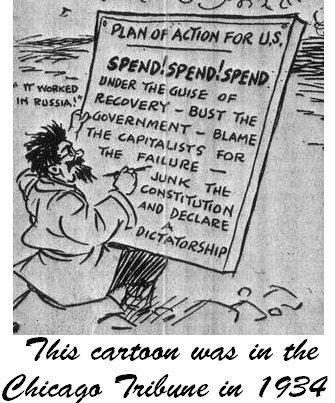

Everything that is currently going on in the US... government "stimulus", massive deficits, pending bankruptcy and the use of the crisis to institute more government controls and blame the "free market" has already happened twice in the last century in the US. The following cartoon with the outline of the grand plan was printed in the Chicago Tribune in 1934, just after the first bankruptcy of the US Government in 1933.

Sound like a familiar plan?

The US Government, after installing the communist-fashioned Federal Reserve system in 1913, and the subsequent war it enabled, World War I, just a few months later, had already bankrupted itself by 1933. That was when the US Government had to confiscate gold and then devalue the US dollar in order to survive. That was US bankruptcy #1.

Then after bankrupting itself during World War II and the Vietnam War, the US was again bankrupt and the only way to salvage itself was to remove all gold backing from the Federal Reserve Note and go to an unbacked fiat currency on August 15, 1971. That was US bankruptcy #2.

Mostly through the use of force and the deceit of inflation, and on the backs of a population of the

world's most productive people, the US Government managed to keep the latest iteration of the Government and the dollar alive until now.

With each bankruptcy, the US Government has taken more and more control of the area in which it operates and, for all intents and purposes, the US is now a dictatorship. It's just one in which you vote for a new dictator every four years, but nothing changes.

We are now all of the way through the plan. "Spend Spend Spend" occurred every year from 1971 to now. "Under the guise of recovery bust the government" has also now occurred. "Recovery" has been what they've called every major inflation after every bust since 1971... the problem now is that any further major inflation will push the Federal Reserve Note into hyperinflation. "Blame the capitalists for the failure" has been instituted thanks to control over most of the enslaved populations minds through 12-16 years of statist indoctrination and control of the media, the majority of Occupy Wall Street blames today's problems on the free market. "Junk the constitution" has also been in process for years but the final coup de grâce was instituted on New Year's Eve, 2011, with Dictator Obama declaring the Bill of Rights to be null and void with the passage of the "National Defence Authorization Act". And, as we stated, today's US democracy is a dictatorship for all intents and purposes.

So, all that is remaining is the collapse. In 1933 it ended with gold confiscation and dollar devaluation. In 1971 it ended with the gold backing being removed completely from the Federal Reserve Note.

What will it be this time? If all of the actions of the US Government and the Federal Reserve for decades is any indication, this collapse will occur with a hyperinflation of the Federal Reserve Note. It's either that or a US Government default that will have very similar results, at least in the short term. Complete obliteration of the economy and of life as we know it in the US and for much of the western world.

In either case, survival depends on disconnecting yourself as much as possible from the western world. First, disconnect yourself from the western financial system by moving most of your assets into hard assets under your own control or in foreign jurisdictions. If you buy gold & silver stocks, which very well could turn into the greatest bubble in all of human history as governments worldwide move ever closer to hyperinflation, then just make sure you register your shares properly so that you retain ownership of your gold and silver mining shares even in the event of the inevitable demise of your brokerage (you can do this by following the process denoted at TDV's BulletProof Shares).

And, if possible, live outside the western world. Many countries in Asia and Latin America are highly amenable to sitting out the next few years of chaos and turmoil. Each month in TDV we look at a different country for homesteading. And we recommend getting a second foreign passport - our current favorite jurisdiction is the Dominican Republic.

If you have to stay put in the western world, live outside of population centers and stock up on food and weapons... and even that probably isn't going to be good enough. War, false-flag terrorist attacks, violence, riots and theft will be the order of the day. Don't blame us... blame this untenable statist system of slavery and theft that so many have dutifully supported for decades.

Don't worry, it's not the end of the world and it's not the first time. It's all been done before. And it will continue to be done for perpetuity until human beings realize that government is slavery, war, theft and death. Until then, we'll be living on some tropical island or beach or out-of-the-way, self-sufficient ranch surrounded by nothing other than mountains, goats and sheep... and hope our HDTV satellite feed or high-speed internet connection stays up long enough to watch the final stages of the collapse.

http://www.marketoracle.co.uk/Article32572.html

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_bpoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_bpoz_2.gif)

No comments:

Post a Comment