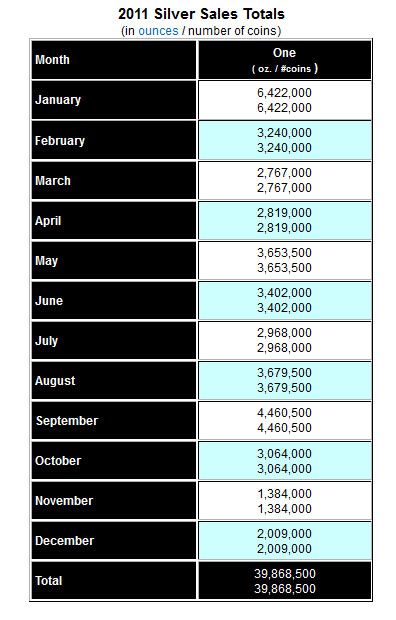

Sales of the Silver Eagle bullion coins increased by 13.3% in December to 2,009,000 compared to last year's sales of 1,772,000. For all of 2011, total Silver Eagle sales came in at an all time record high of 39,868,500 ounces, up 15.0% from the prior year's total of 34,662,500 ounces.

In addition to the silver bullion coins, the U.S. Mint also produces proof and uncirculated American Eagle silver coins which can be purchased by the public directly from the U.S. Mint. Commencing in 2010, the U.S. Mint began producing the America the Beautiful Silver Bullion 5oz coin. During 2011, the U.S. Mint sold 397,700 of the 5oz coins, which represents almost another 2 million ounces of physical silver demand during 2011.

The U.S. Mint does not sell the American Silver Eagle bullion coins directly to the public. The bullion coins are purchased from the U.S. Mint by a network of authorized purchasers who in turn resell them to secondary retailers for public sale.

Monthly sales of the Silver Eagle bullion coins during 2011 are shown below.

Silver had a volatile year during 2011, reaching a high of $48.70 in April and then dropping to a low of $32.50 in May after the COMEX repeatedly raised margin requirements on silver futures (see How the COMEX Crashed The Silver Market). After recovering to $43.49 in August, silver declined to end the year at $28.18, off 8.1% for the year.

Despite the volatility in silver prices during 2011, investor demand for physical silver remained exceptionally strong. After the significant price pullback from the April high, many analysts and armchair commentators who never owned an ounce of silver in their life were predicting a plunge in demand for silver. The exact opposite occurred as long term investors took advantage of what is another historic buying opportunity comparable to 2008.

The case for buying silver remains rock solid and patient long term investors have been well rewarded. As opposed to buyers of paper silver products such as the iShares Silver Trust ETF (SLV), holders of physical silver are invested in precious metals as part of a long term wealth preservation and appreciation strategy. While speculators in paper silver products trade in and out, usually winding up with losses from my observations, long term holders of physical silver have seen the value of their holdings rise significantly.

As central banks of the world continue to print money at an accelerated rate, 2012 should be a year of strong gains for both gold and silver. A steady plan of silver and gold bullion accumulation remains a no-brainer decision. Since 2008, sales of silver eagle bullion coins have soared. Last year, extremely heavy demand for silver resulted in periodic product allocations by the U.S. Mint.

In an excellent article by Steve Angelo, it was shown that massive physical demand for both the American Silver Eagles and Canadian Maple Leaf coins resulted in official coin sales surpassing the total silver production of both the United States and Canada.

Expect demand for silver bullion products during 2012 to surpass the record year of 2011. Shown below are the yearly sales figures since 2000 for the American Silver Eagle bullion coins.

| American Silver Eagle Bullion Coins | ||||

| YEAR | OUNCES SOLD | |||

| 2000 | 9,133,000 | |||

| 2001 | 8,827,500 | |||

| 2002 | 10,475,500 | |||

| 2003 | 9,153,500 | |||

| 2004 | 9,617,000 | |||

| 2005 | 8,405,000 | |||

| 2006 | 10,021,000 | |||

| 2007 | 9,887,000 | |||

| 2008 | 19,583,500 | |||

| 2009 | 28,766,500 | |||

| 2010 | 34,662,500 | |||

| 2011 | 39,868,500 | |||

http://goldandsilverblog.com/demand-for-silver-bullion-coins-hits-record-high-on-bargain-prices-0336/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_bpoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_bpoz_2.gif)

No comments:

Post a Comment